Online Banking Solution

Our Electronic Banking System for successful onboarding, retail and corporate online banking

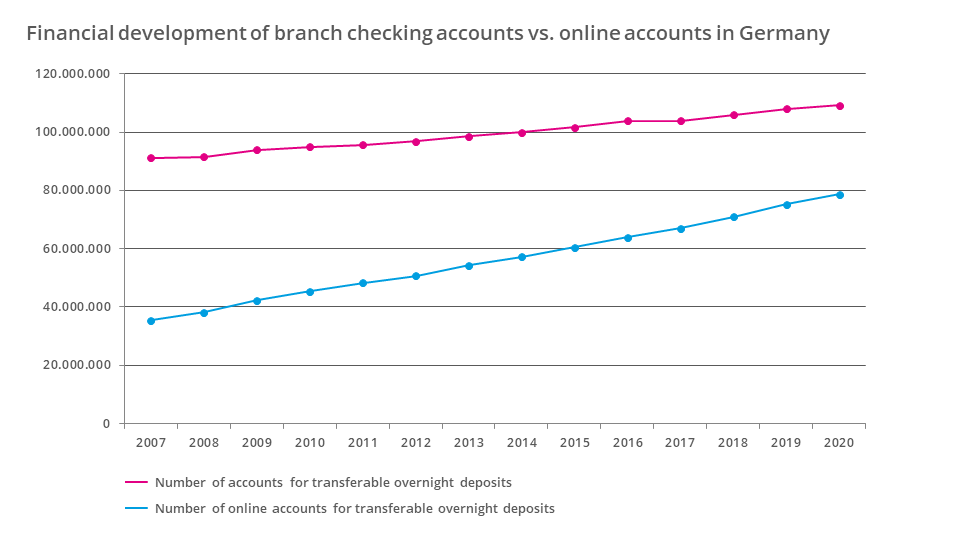

Today, banking transactions are increasingly conducted digitally. As reported by the Federal Statistical Office, 64% of private households in the 25 to 44 age group used the Internet for online banking activities in 2021. The quality of online banking today offers a high potential for differentiation and has long since ceased to be an option for banks. Instead, it has developed into an important unique selling proposition. The key to the digital transformation of banking is the customer experience. Our innovative online banking solution is geared towards an optimal user experience, from new clients acquisition and onboarding to self-services in online banking, and makes a significant contribution to the automation and digitization of banking transactions.

The PASS Electronic Banking Solution combines user-friendly operation with high functionality and modern design. Online banking products can be completed easily and securely and bank clients can execute their financial transactions conveniently at any time and from any location. All customer correspondence (account statements, messages, etc.) can be reproduced via the digital post box and an optional long-term archive and is an important component of any digitization strategy. Numerous management functions increase ease of use and enhance the clients' security perception. Even complex rules of disposition and approval are mapped simply and comprehensibly thanks to a well thought-out user guidance. The powerful Web API according to ISO 20022 standard enables the connection of different core banking systems as well as other third-party systems. Larger customer payment orders can be transferred via XML files. Batch/mass processing is also possible.

-

Optimal onboarding process for new and existing customers – online product closing with digital legitimation procedures (new clients)

-

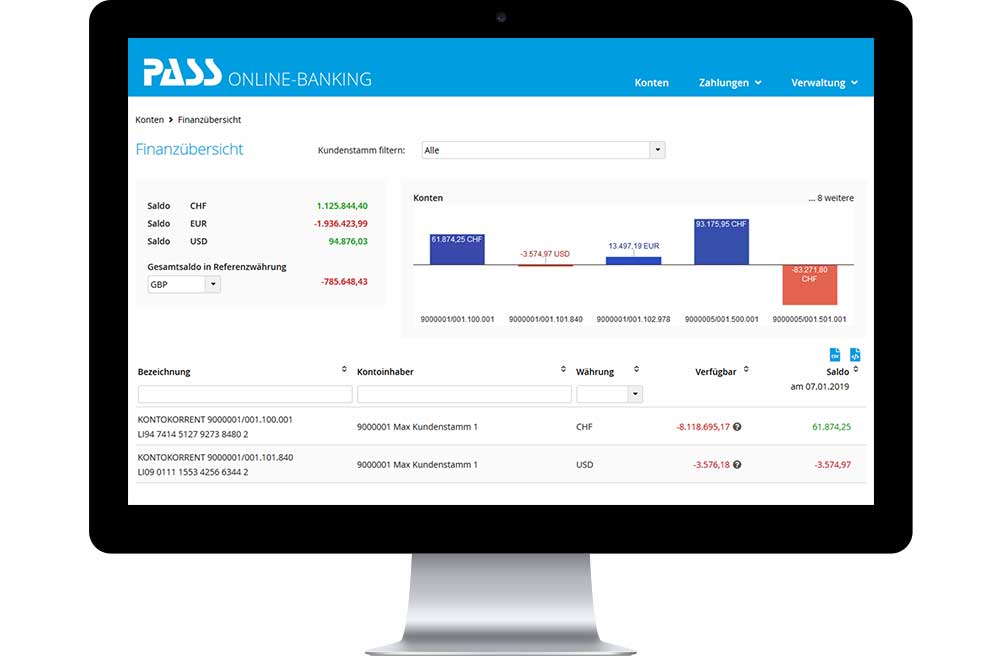

Innovative display of financial status, account information (graphical and tabular), account balances and any length of transaction history

-

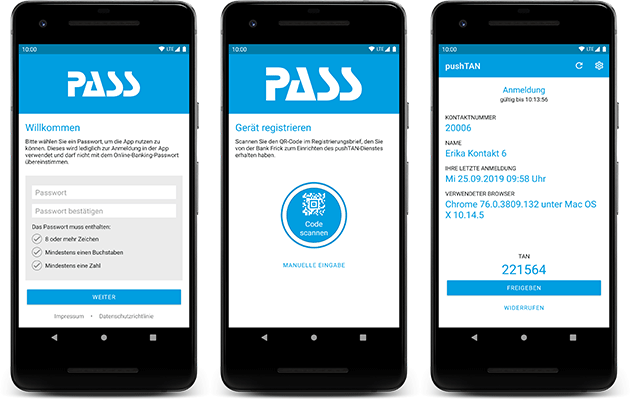

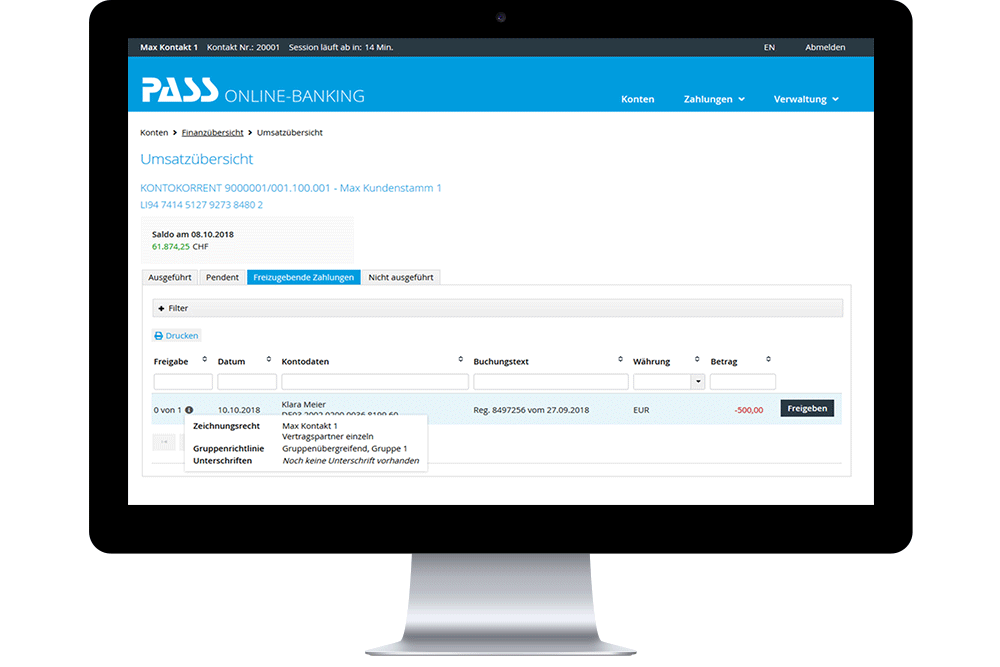

Intuitive creation and authorization of payment orders (SEPA credit transfers, internal transfers, SWIFT payments, Swiss market transfer forms) via SMS TAN or pushTAN-App

-

Online product closing with just a few clicks directly in the online banking system

-

Digital mailbox with optional long-term archiving

-

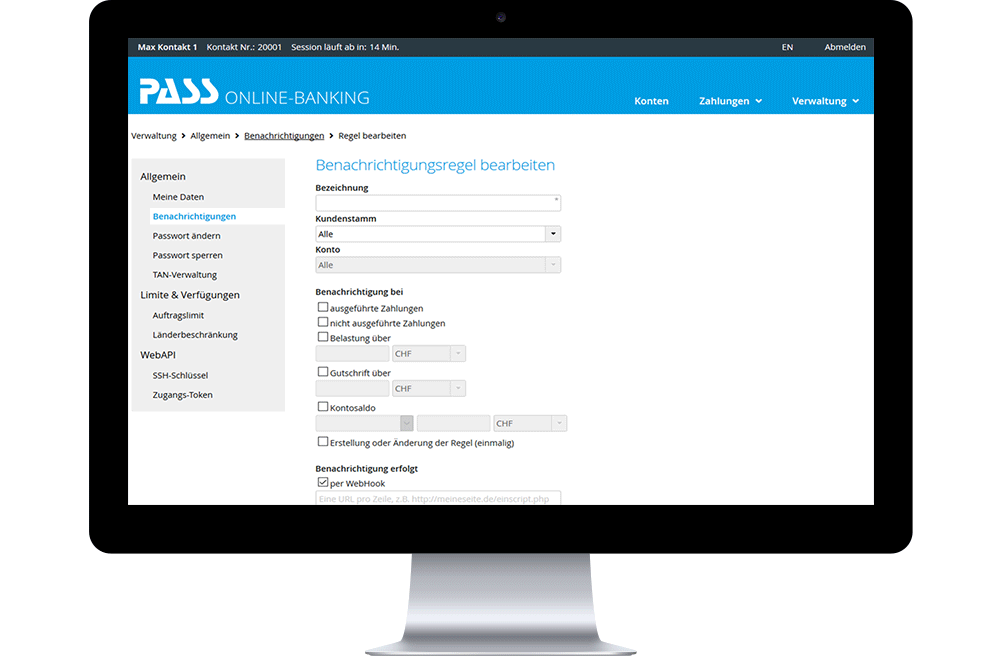

Comprehensive notification system (clients-specific notification rules for events, such as limits reached, balances, incoming and outgoing payments, new documents, etc.)

-

Highly automated onboarding process for new and existing customers

-

Integrated generation of PIN and access data letters possible

-

Administration, blocking and resetting of customer account

-

Information system for creating system and marketing messages

-

Defining individual rules for password conventions in online banking

Fast and intuitive operation

The internet banking solution is a modern web interface, which can be used on various terminals due to its responsive design. At the same time, various security mechanisms are integrated into the online banking solution.

Extensive configuration functions

The internet banking solution integrates comprehensive configuration functions such as authentication, authorization systems and support for IBAN Plus and ABA routing numbers.

Interface according to ISO20022 standard

The interface enables more efficient transaction processing thanks to the uniform, bank-independent ISO 20022 international standard, while at the same time guaranteeing a high degree of future safety and easy integration of third-party providers.

Support of the intermediary business

The online banking solution supports complex joint decrees and powers of attorney with user and group concepts. This also meets the requirements of financial intermediaries such as financial advisors and trustees.

Variable usage model

The internet banking solution can be made available as a license or in the SaaS model (operation in PASS's own ISO-certified bank data centers).

Bank clients

- Simple and secure processing of banking transactions at any time, from any location and with almost any terminal device thanks to responsive design

- Graphical presentation of the financial overview

- Support for bulk payments

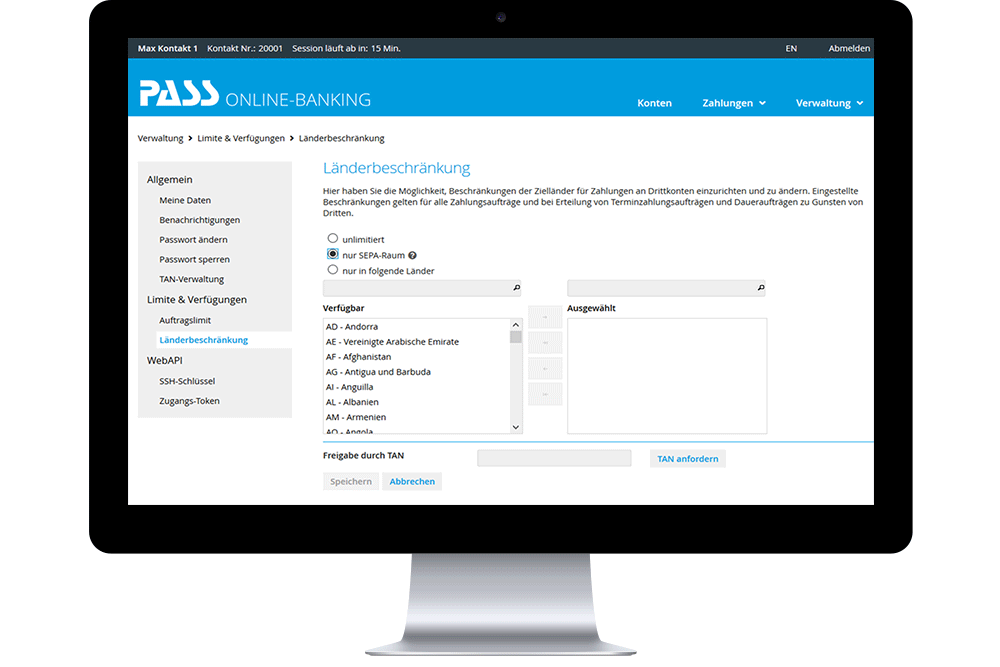

- Safety features such as country restrictions and limits for transfers

Banks

- Simple connection to various core banking systems and simple customizing to the look & feel of the respective financial institution

- Powerful Web API (ISO 20022 standard)

- Flexible usage models

- Multilingual (German, English)

- Support of several markets (Germany, Switzerland, Liechtenstein)

IT / Department

- Can be used as web application OnDemand without local software installation

- Can be used as a module within the core banking system or independently

- Very easy to integrate into a web-based infrastructure

- Various security mechanisms, e.g. 2-factor authentication

- Easy integration of third-party applications through Web API

- Paperless communications with customers

Management

- Optimal onboarding sets the course for the customer relationship, enables an increase in new clients acquisition and is an essential component of a digitization strategy

- Comprehensive self services increase the customer experience and thus customer loyalty and efficiency

- Client interactions are fully automated

- Uniform processes and secure data storage guarantee complete transparency

An international private bank uses our online banking software to offer its customers a modern and secure banking experience. PASS supports the private bank in the digitization process from payment transactions to crypto trading. From the automation of payment workflows to the integration of PSD2 interfaces and Push TAN App for secure authentication, our customized software solution was able to provide comprehensive support. Through continuous market studies and technological advancements, PASS ensures that online banking always meets the current requirements and needs of customers.

"Thanks to the new workflow, the customer benefits from significantly increased efficiency and we laid the foundation for further cooperation through the convincing implementation. In the meantime, we have expanded the workflow to include several channels and jointly advanced the topics of online banking and crypto trading and management."

– Ole Barkmann, Head of Business Development Banking bei PASS

Our Services

The special feature of the PASS Online Banking Solution is that it can be used both as a component of the PASS Core Banking System and as an independent module.

We offer comprehensive services for both cases:

- Consulting

- Licensing

- Customizing

- Integration

- Extension (incl. requirements analysis, conception and implementation project)

- Hosting in our ISO-certified bank data centers in Germany

Type of use

Licensing

SaaS

Licenses

One-off purchase price

The license is included in the monthly service fee.

Is maintenance necessary?

No, but recommended

Yes, the client benefits from the ongoing development of the product. New versions of the online banking solution will be made available at certain intervals.

Maintenance costs

20 % of the license price (per year)

Are included in the service charge

Is an installation necessary?

Yes, this can be done via download or FTP transfer

Yes, this is done by the service provider/PASS

Optimally suited for

Banks wishing to operate the electronic banking solution in their own data center

Banks that wish to receive the entire service largely from a single source

Advantages

a) Lower cash flow burden in subsequent years

b) Flexibility to provide complementary services yourself or to purchase from other companies

a) Everything from a single source

b) Uniform service package

c) Hosting in Germany

Thanks to the included standardized interfaces according to ISO20022, the requirements of the PSD2 directive for account information and payment triggering can usually be easily implemented. However, this is strongly dependent on the core banking system used and the services to be connected. The requirements for strong customer authentication (knowledge and ownership) are covered by the use of the pushTAN process.

The following security mechanisms are integrated into the online banking solution:

- Login/2 Factor Authentication

- Strong customer authentication via pushTAN for the release of transactions – further procedures can be integrated on request

- Authentication, including via private/public key in batch mode (for mass releases)

- Clients-specific security parameters such as country restrictions and maximum amounts for outgoing payments