PASS Loan Engine: New credit products at the touch of a button

Configure and set up credit products quickly and easily using the lending management software

Digitalization is also increasing the pressure on the credit market. Financial service providers need to respond quickly to new requirements. With the credit management software PASS Loan Engine, a wide range of financing products – from annuity loan to leasing product – can be configured via a wizard and implemented at the touch of a button.

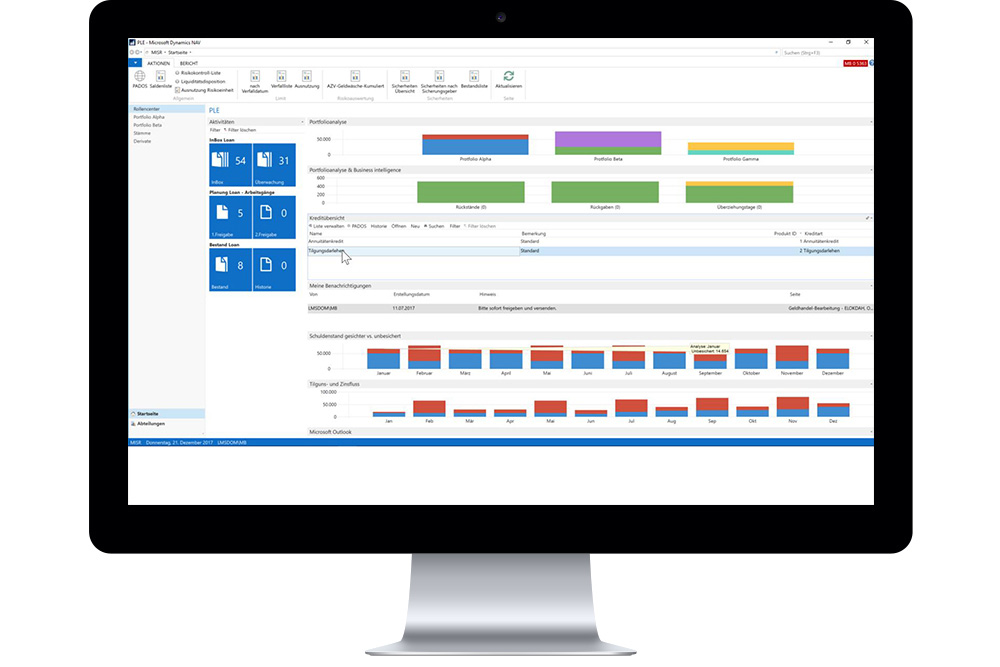

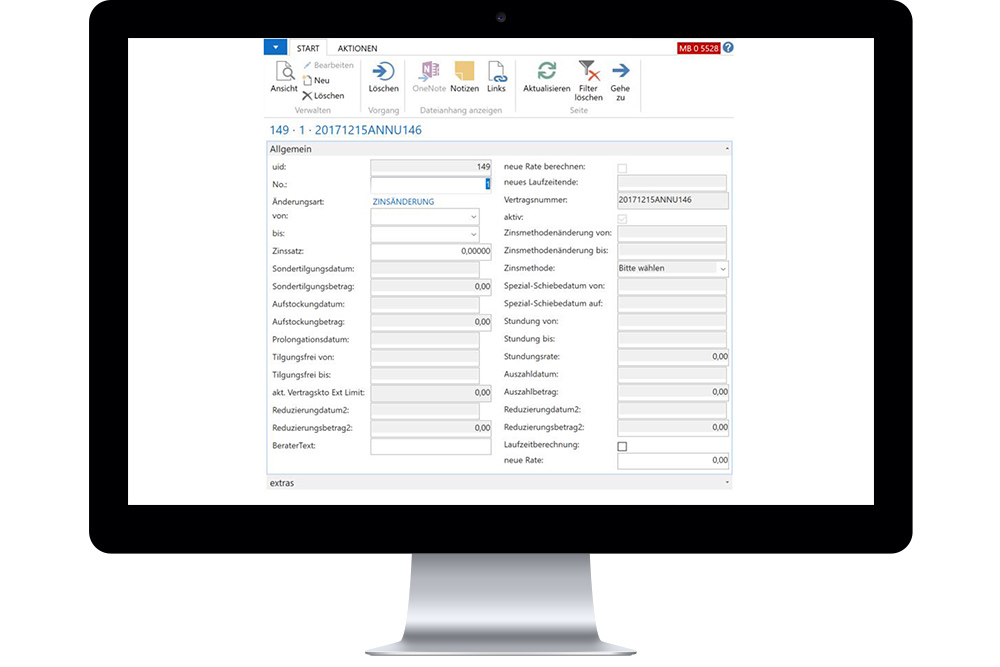

Our lending management software consists of two parts, a loan management and product configurator software. It offers banks, FinTechs and financial service providers the complete processing and contract management of credit agreements. You can handle application workflows as well as dunning and receivables management holistically in the PASS Loan Engine and manage international loan portfolios.

The lending management software covers all typical parameters and process of credit products. It can also be easily and quickly extended by further individual, bank-specific parameters, from the sales process via API to the settlement of contracts.

The process engine automatically works through defined workflows, back-office processes and regulatory requirements according to your specifications.

Lending management software components

The Lending Engine consists of a product configurator and a product management component.

Product configurator

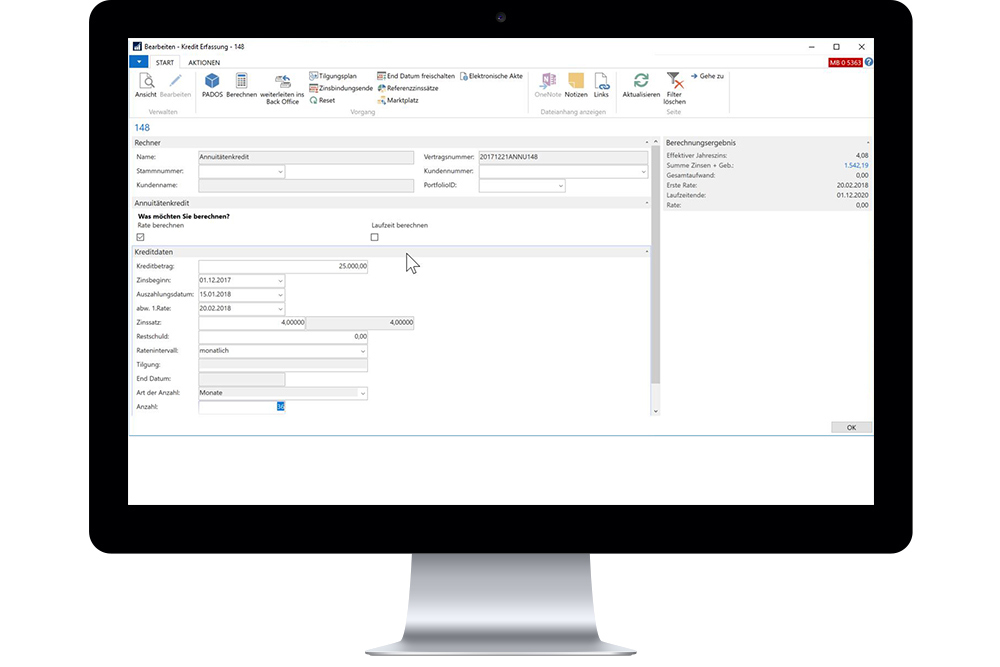

With the product configurator software you define the individual loan products you want to offer. For this purpose, an extensive repository of function modules is available to you, such as:

- Installment interval

- Installment rounding

- Installment postponement (postponement of the first installment)

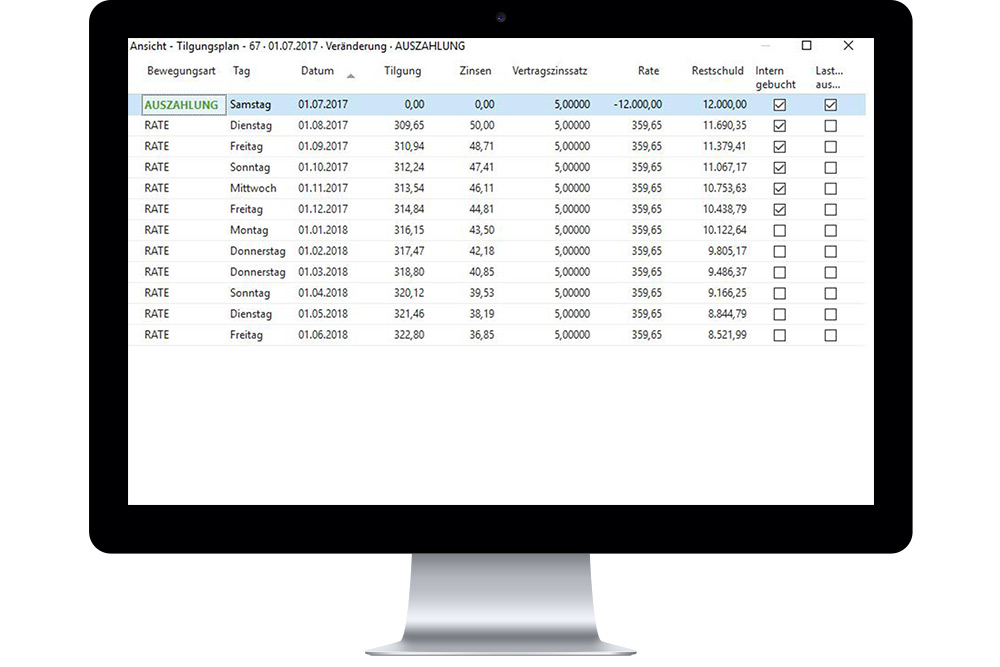

- Redemption schedule calculation: redemption and annuity calculation

- Repayment-free period for real and non-real forward loans

- Value +/- Days: Info field about time-shifted debit in the redemption schedule

- Disbursement payment schedule modalities: Holiday calendar, postponement

- Disbursement date / rate dates

- Difference between value and real payment date

- Requested redemption before offer

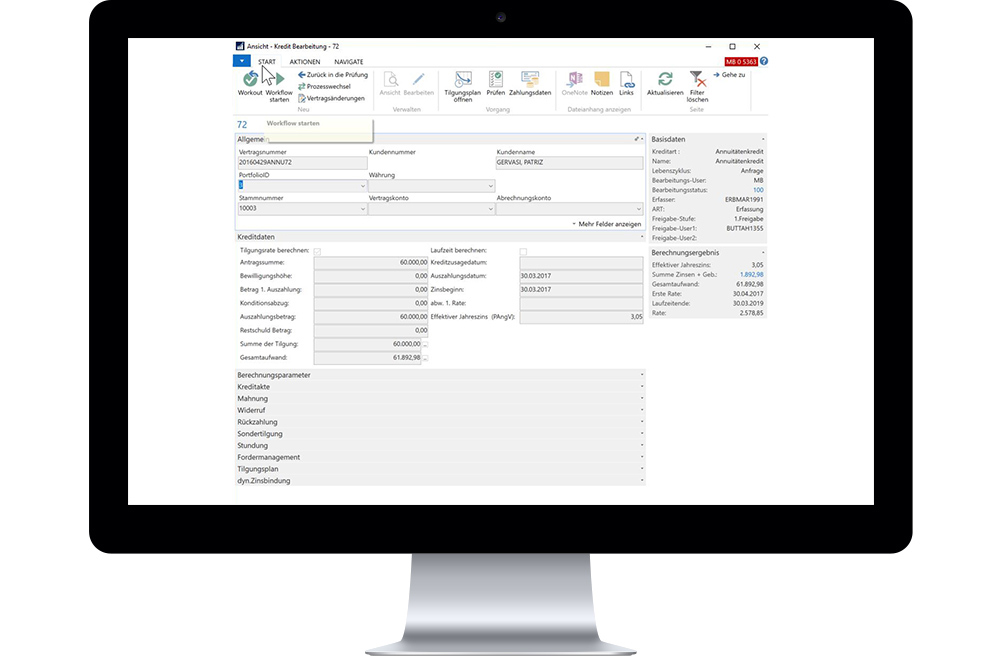

An internal workflow is created from several function modules. If smart agents are added to the workflow as control components or linked to external processes, the credit product is created.

PLE enabled Contextual Banking

In addition to the use as an integrated, but still very flexible loan management solution, the function modules, workflows and smart agents can also be addressed via webservices.

- Offer creation (provide redemption schedule)

- Offer acceptance (transfer of the loan to the back office, in some cases with fully automatic checking and disbursement on request)

- Deposit of additional credit addresses

- Deposit/change of reference account for disbursements and installment collection

- Rejection of the offer / cancellation of the credit request

- Query of credit details

- Interest rate changes

- Unscheduled redemptions

- Loan repayment (complete)

- Deposit of credit special fields

- Creation of securities

This enables financial service providers to implement context-related use cases, such as calculating a loan offer or redemption plan at the point of sale.

Product management

In addition to configuration, the Lending Management Software supports the complete lifecycle of a credit product – from sales to conclusion, disbursement, repayment, administration, dunning and recovery.

DYNAMIC PRODUCTS

Dynamic creation of new credit products with interest rates, graded interest rates, floating rates, repayment dynamic, vario capital etc.

RATING & SCORING

Possible to activate the automatic requesting of ratings or external connection to scoring such as SCHUFA for products created

PROCESSING WORK FLOWS

Definition and depiction of processing and back office workflows as well as automatic execution by the process engine

SALES VIA MOBILE DEVICES

Credit calculation and preparation of quotation via tablet and mobile device at the customer’s location

Automated monitoring of credit processes

Cyclical checking of credit processes for changes and execution of predefined actions via Smart Agent

GENERICALLY EXPANDABLE

Quick and modular expansion of the parameters in theder lending engine with regard to bank-specific requirements

Functionality*

Standard

Extended

Executive

Payout / payment plan modalities (public holiday calendar, postponement of payout date/installment dates)

Difference between value date and real payout

Final and processing fee

Maturity structure (interest and redemption)

Trash

Repayment schedule calculation

Interest methods (30/360, act/360, act/365, act/act)

Premium/discount

Limits for the loan amount

Conditions management

Insurance fees

Acquisition / takeover of credit portfolios

Construction financing (follow-up interest rate)

Leasing

Money and capital markets: connection to the PASS Loan Engine

Calculation of a repayment plan

Dynamic interest rate adjustments

Functionality*

Standard

Extended

Executive

Posting Records/Templates with Information for standard business cases

Mapping of all regulatory requirements

Access to core banking data

User interface for entering all personal and credit application-relevant data

Cyclical checking of the system for changes

Automatic distribution of loan payments, installment payments, etc.

Access to Bundesbank time series

Skype Online Advice/Customer Identification

Execution of predefined tasks

Subsequent entry of workouts

Establishment of individual booking records

Free choice of booking codes and prime notes

Using the Smart Agent

Connection to an existing personal database

P2P Lending from private individuals and bank as intermediary

PRODUCT SPECIALIST

- Implementation of new credit products in a few days instead of months (short time-to-market)

- Higher budget for product advertising and marketing

- Simple product and intermediary management

IT OFFICER

- Easily connect accounting and payment flows and reporting (SEPA, target, swift etc.) via webservice

- API for regulatory requirements

MANAGEMENT

- Reduction in operational and personnel costs through automated process flows (BPM) and digitalization

- Drastic reduction in software development and product maintenance costs (in particular for software providers)

- Competitiveness and unique position through faster product adjustments

Interfaces

The architecture of the loan management software can be quickly connected to other applications and Core Banking Systems (CBS) via various interfaces (e.g. web services):

Marisk

The credit product configurator software possesses an interface to connect systems to depict the minimum requirements placed upon risk management.

SCHUFA

SCHUFA requests can be prepared and made in the system using data already collected.

PAYMENTS

An interface for payment engines facilitates automatic nostro account management and SEPA-compliant payment processing, including standing order management.

ACCOUNTS

The core banking connection of the loan management software has an interface to open accounts of various types and keys.

MASTER DATA

The lending management software collects all the necessary master data in order to meet the regulatory requirements of a core banking system.

REPORTING

Data from the area of CRM and contractual management form the basis upon which the reports are generated.

Our lending management software permits all manners of lending business products to be created and can therefore be used by banks, insurance companies, large organizations, trade enterprises, factoring companies, leasing companies, financial service providers, financial intermediary agencies and FinTechs.