Full regulatory reporting system

Create extensive external reports with our regulatory reporting software

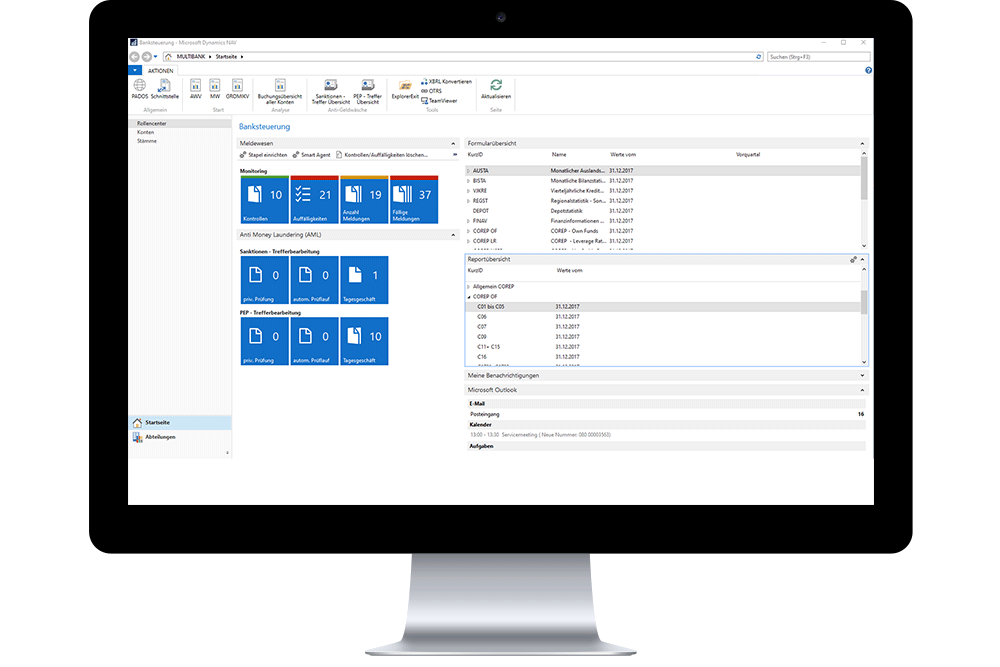

Regulatory reporting is becoming increasingly complex for banks due to numerous notification and reporting obligations towards the banking supervisory authorities. Our regulatory reporting solution ensures that notifications and reports are generated on time and in accordance with German law. On the basis of the information from the PASS core banking system, all relevant reporting data is automatically checked, validated and reported to BaFin or the Bundesbank via standardised interfaces. A manual adjustment is possible at any time.

Our approach is to develop a comprehensive and integrated – yet modular – reporting solution to fully map banks. This means that the regulatory reporting software can be used both independently and in combination with the PASS core banking application.

In addition to our own reporting solution, we also have integration partnerships with standard software providers, such as BSM for the BAIS application and Regnology for the Abacus360 Banking application.

Scope of services

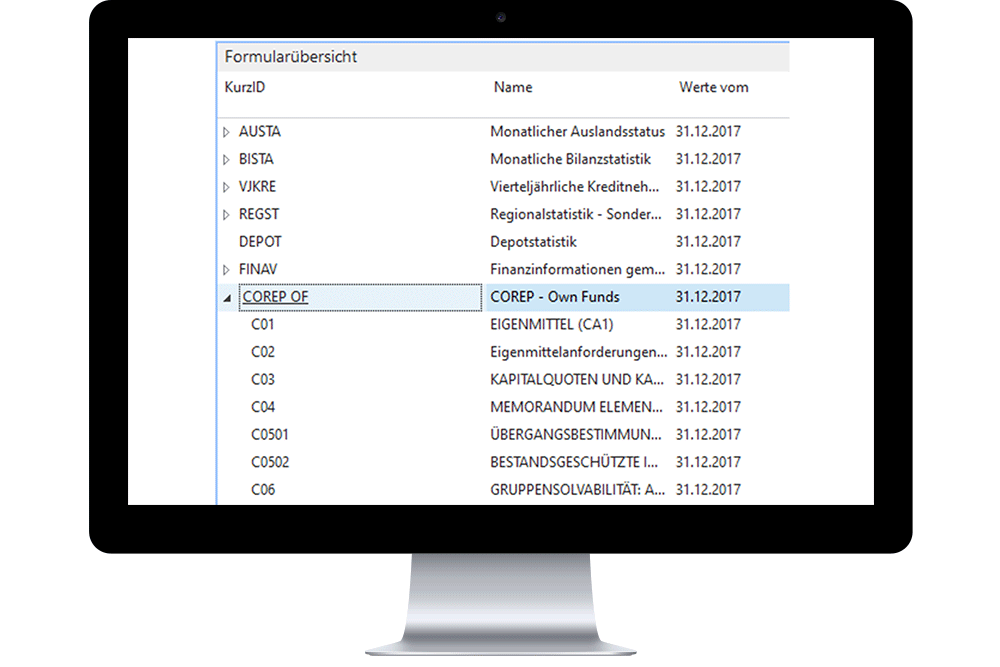

The following regulatory reports can be created with our regulatory reporting software:

-

ANACredit (Analytical Credit Datasets)

-

Foreign status

-

AWV (Foreign Trade Ordinance)

-

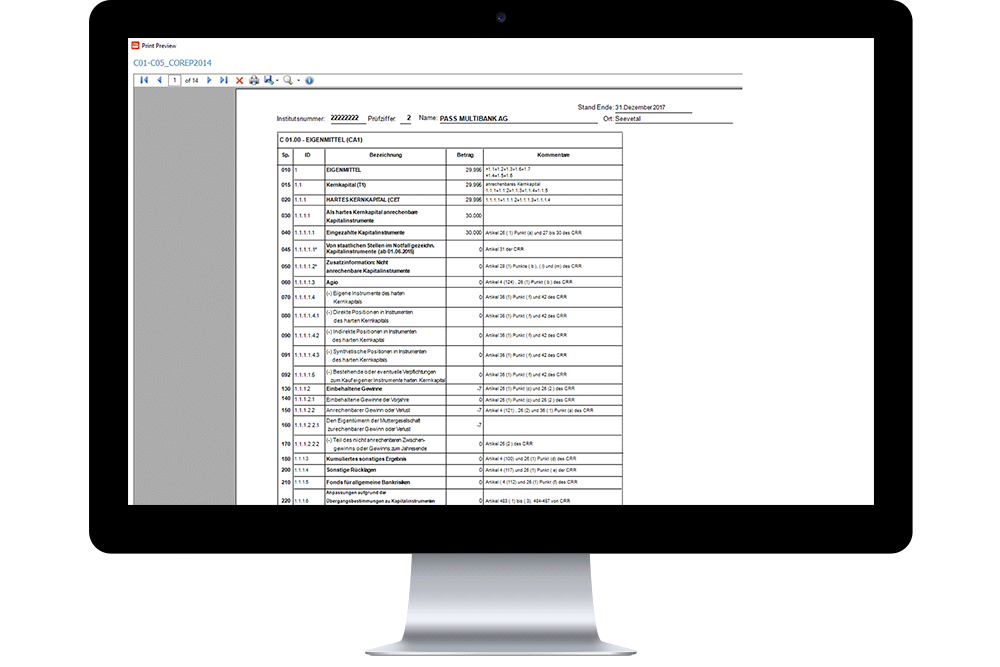

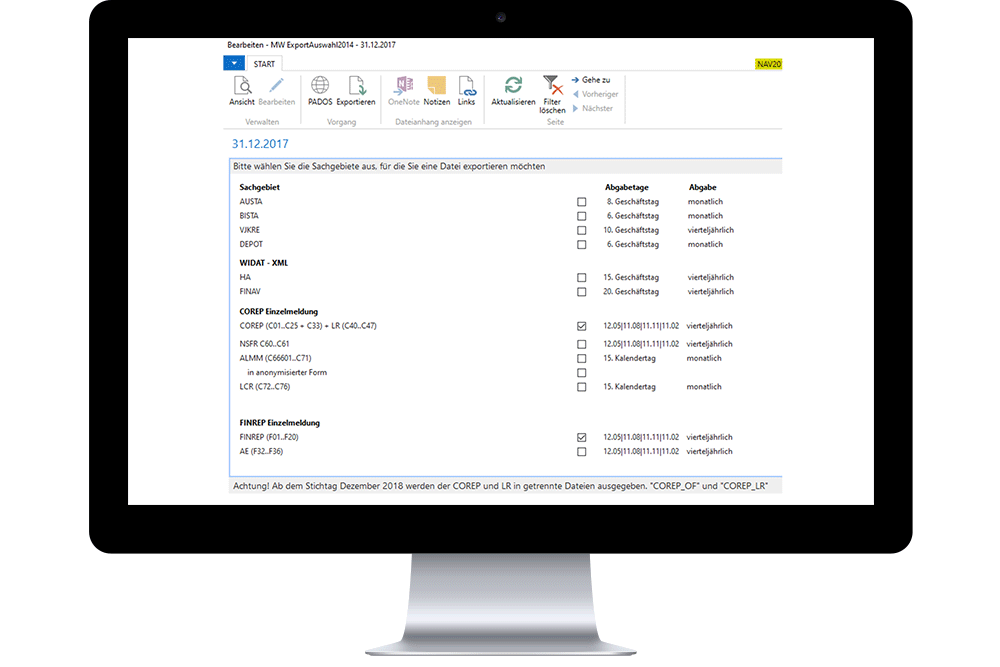

COREP (Common Solvency Ratio Reporting) & Co

-

EAEG (Deposit Protection and Investor Compensation Act)

-

FinaRiskV-RTF (Financial and Risk-bearing-capacity Information Ordinance)

-

FinaV (Financial Information Regulation)

-

FinRep (Financial Reporting)

-

FinRep AE (Financial Reporting for Asset Encumbrance)

-

Million Credit Report

-

Account Retrieval Procedure according to § 24c KWG

-

Statistics (e.g. money market, balance sheet, borrower, payment transaction and ZVDL statistics, statistics on securities investments)

-

and many more

-

Fulfilment of legal reporting requirements

-

Comprehensive and integrated regulatory reporting software (stand-alone or as part of our core banking solution)

-

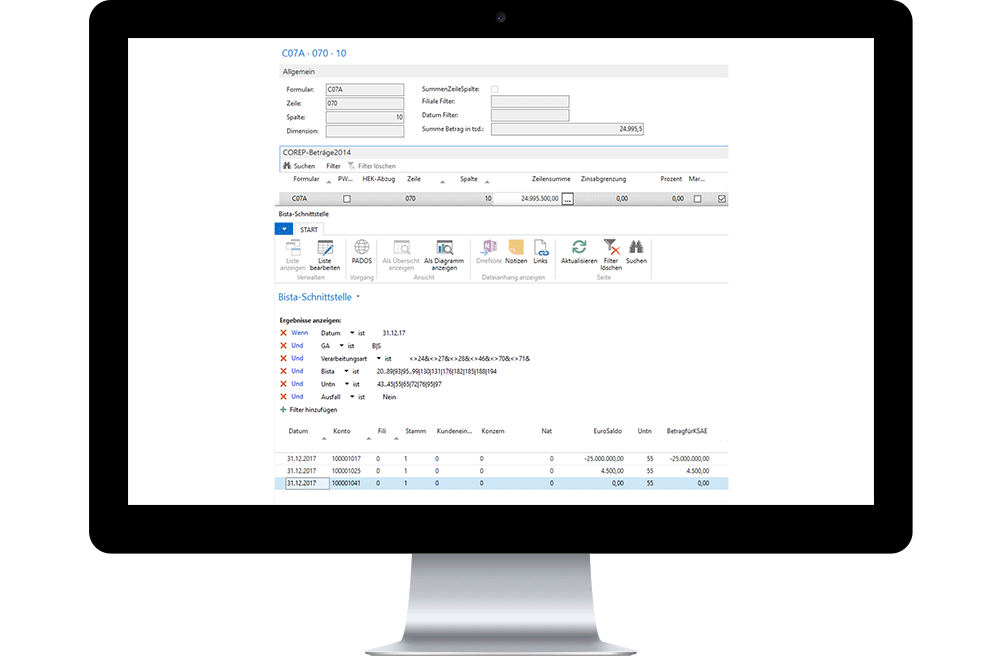

Core banking system serves as consistent database and therefore there is no deviation between the data and the reporting inventory

-

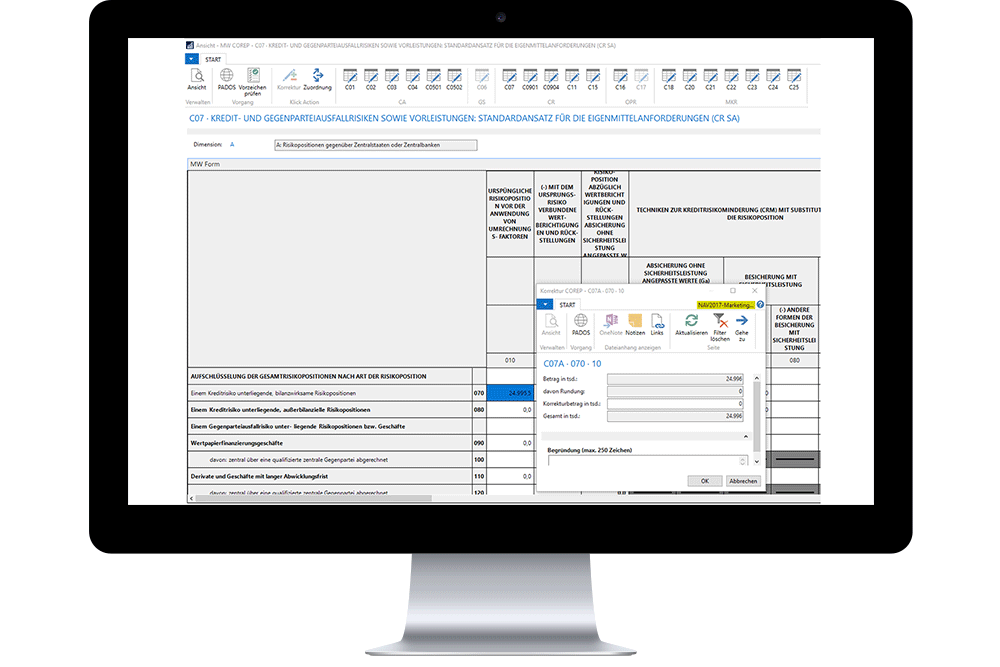

Direct drill down from the reporting interface to individual trades or transactions

-

Automatic selection of all data relevant to the report

-

Manual check/validation of messages and processing if necessary

-

Output and conversion to the required message format