Payment providers such as PayPal and Apple Pay have transformed transactions, setting new standards in terms of speed, simplicity and digital accessibility. This is putting pressure on companies to modernise their internal payment processes.

PASSmultiPay is the perfect solution: a powerful, automated payment platform that reliably processes payments, including real-time transactions, while meeting compliance requirements and maintaining efficiency, even with large volumes.

PASS is a certified Routing and Verification Mechanism (RVM).

As one of the few certified RVMs, PASS also offers VoP as a service. This enables banks and companies to enjoy the benefits of certified quality and maximum security, as well as gaining a clear competitive advantage in payment transactions.

High performance

PASSmultiPay enables fast and efficient payment processing even with large transaction volumes.

High level of automation

Our platform automates payment processes, reduces manual work, and saves time and resources.

Regulatory compliance

The system meets requirements such as DORA and PSD2 and adapts flexibly to new standards.

Since 2017, the SEPA Instant Credit Transfer (SCT Inst) procedure has enabled transfers of up to €100,000 within ten seconds – around the clock. Nevertheless, instant payments currently account for only around 20 percent of all euro transfers (as of Q3/2024). A legislative initiative by the EU Commission is now set to change this:

-

All payment service providers must offer real-time transfers in euros.

-

Fees must not exceed those of standard SEPA payments.

-

Requirement of Verification of Payee (VoP)

-

Daily comparison with EU sanctions lists is mandatory.

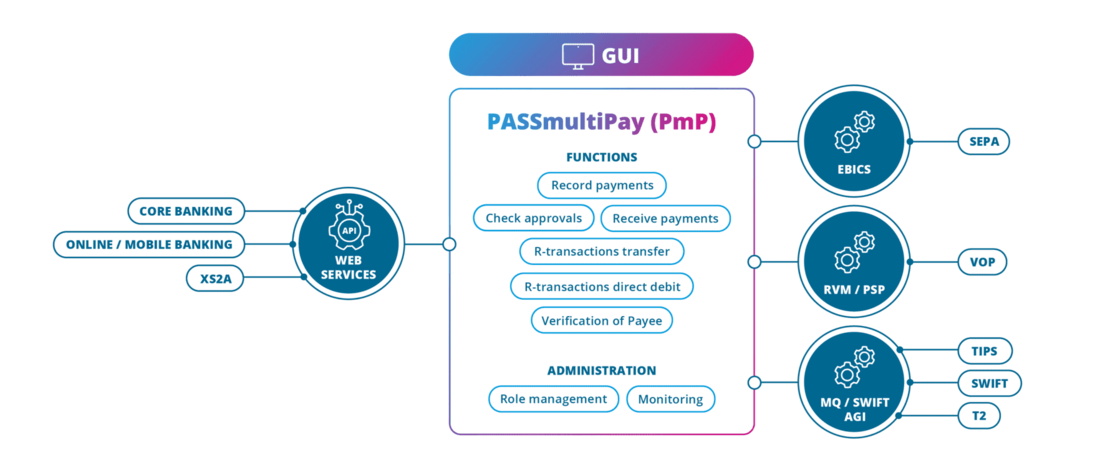

PASSmultiPay (PMP) connects core banking systems, banking apps, and payment initiation services via modern web services. The platform also enables the processing and management of all payment transactions such as SEPA, TIPS, or T2. All functions can also be executed manually via an intuitive graphical user interface.

T2 Services

Central liquidity management with administration of main accounts and sub-accounts as well as settlement of payments via the RTGS system.

Instant Payment Services

Real-time transfers 24/7 with credit to the recipient's account within 10 seconds in accordance with Bundesbank specifications.

AML-Check and disposition check

Automated checks for sanctions and politically exposed persons (PEPs) as well as regular monitoring of customer data and account coverage.

SEPA Services

Standardized, fully automated processing of euro payments in the SEPA region using established message formats.

SWIFT Services

Processing international payments with the new ISO 20022 formats – efficient thanks to a high degree of automation.

Verification of Payee (VoP)

IBAN name matching of the recipient to detect and prevent fraud attempts using false account details at an early stage.

-

Individually scalable microservice architecture

-

Platform and branch capability

-

SDKs for developers to implement customized partner solutions and digital payments

-

Open architecture – can be integrated into core banking and third-party systems or used as a stand-alone solution

-

Automated integration tests to reduce the workload for banks and their employees

-

Reliable 24/7 and 365-day operation

-

Intuitive user interface

-

Integrated customer/dashboard area

-

Ideal for banks, fintechs, payment service providers, and institutions

-

Process and product configurator enabling financial institutions and payment providers to build payment solutions without software development.