VoP is on its way – act now!

From October 9, 2025, all payment service providers in the euro area will be required, under EU Regulation 2024/886, to verify whether the recipient’s name and IBAN match before executing a payment (Verification of Payee). The regulation aims to make payments more secure, prevent fraud such as CEO fraud, and offer better protection for consumers.

Implementation will take place in stages. From October 2025, recipient banks must be able to respond to verification of payee (VoP) requests. From April 2026, paying institutions will also be required to perform the comparison in real time.

![]()

You can find out more about "verification of payee" in our blog post.

Requirements for payment service providers:

To comply with the EU Regulation, payment service providers and institutions must implement the following measures:

-

Real-time name-IBAN matching before every transfer

-

Alerts on mismatched transfer details

-

Option to correct or cancel

-

GDPR-compliant implementation

-

API interface for third-party providers

-

Complete process documentation

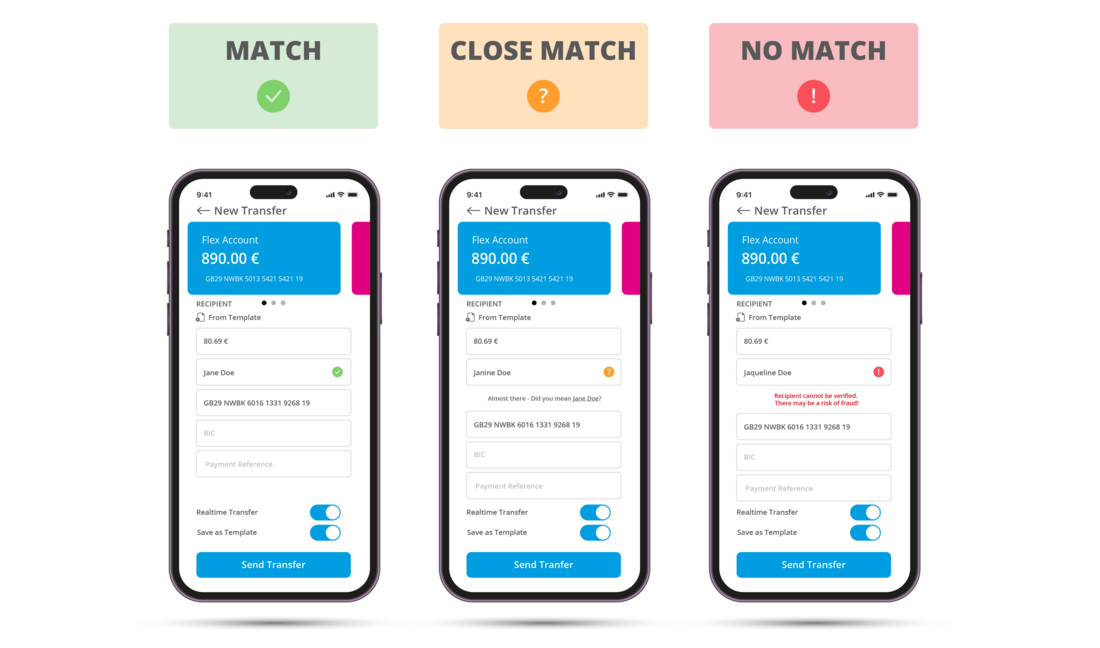

When a VoP request is initiated, the payment service provider sends the recipient's name and IBAN to the relevant provider for verification. This request is routed through the EPC Directory Service. The response – 'Match', 'Close Match' or 'No Match' – is sent in a standardised format via the Response Validation Mechanism (RVM) and presented to the payer in real time, including any relevant discrepancy notes.

What our solution offers

As part of the Verification of Payee (VoP) process, PASS acts as the Routing and Verification Manager (RVM). This enables active verification of requests (as the Requesting PSP) and responses to incoming requests (as the Responding PSP).

Before initiating a payment, PASS checks on behalf of the bank that the recipient's name and IBAN match.

- Provision of a comprehensive infrastructure

- Integration with PASS Online Banking / third-party providers

- Connection to PASSmultiPay / SolutionWorld Banking

- Support with EPC and EDS registrations and certificate applications

- Local copy of the EPC Directory Service

- Detailed logs and verification evaluations

If a bank receives such a request, PASS will respond technically on behalf of the receiving bank.

- Provision of a robust infrastructure

- Servers available 24/7

- Simple interfaces for delivering data

- Full representation with regard to third parties

- Registration EPC

- Local copy of the EPC Directory Service

- Detailed logs and verification evaluations

Quick & easy connection

Financial service providers can integrate the service quickly and easily without any complex system changes.

Data hosting in Germany

Operations hosted exclusively in certified German banking data centers in full compliance with GDPR.

Open interface architecture

Our solution can be seamlessly integrated into existing systems and payment transaction processes.

Monitoring & reports

Extensive logs and statistical evaluations support monitoring, reporting, and transparency.

IT compliance

Our VoP service complies with regulatory requirements such as DORA, MaRisk, BAIT, and certifications according to ISO 27001 and IDW PS 951.

Extensive expertise

Support with organizational, technical, and specialist questions relating to payment transactions and banking.

![[Translate to Englisch:] ISO 27001 Zertifzierung [Translate to Englisch:] Logo ISO 27001 Zertifizierung](/fileadmin/_processed_/7/6/csm_zertifizierung-ISO-27001_acf7322627.png)

![[Translate to Englisch:] PASS Cloud Services made in Germany [Translate to Englisch:] Logo Cloud Services made in Germany](/fileadmin/_processed_/5/0/csm_PASS_Cloud-Services_Made-in-Germany_Logo_weiss_2f2f37e021.png)